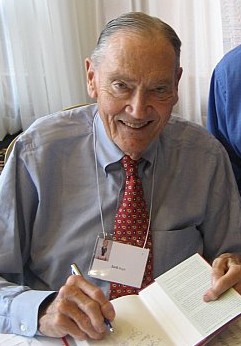

"Bogleheads® emphasize regular saving, broad diversification, and sticking to one’s investment plan regardless of market conditions. We follow a small number of simple investment principles that have been shown over time to produce risk-adjusted returns far greater than those achieved by the average investor. They have been further distilled and explained in thousands of posts on the forum.

The power of the wiki is its ability to link content. If a topic has a link, there’s more material available. This is not a structured course. Use those links to explore anything you want, and consider bookmarking this page in case you get lost. The start-up kits below are designed to help you begin or improve your investing journey."

Thanks for sharing. The Bogleheads philosophy is the best way to in our economies for regular people to maintain and grow their capital. I wish more people were aware of it.

Bogleheads advice doesn’t apply well to the median wage earner in the US.

Curious why you think that? I am not aware of any real alternative.

It’s like telling someone to water their crops while they are experiencing a drought.

I think the hierarchy is

- Balance your budget

- Pay off debt

- Build your future

I totally see where you’re coming from though. It is definitely advice for what to do once you’re not sinking so to speak. It’s advice for step 3 of that process. Folks like Dave Ramsey (who really needs to be taken with a grain of salt, lots of grains) are for step 2 (and maybe 1).

It’s more like telling someone to methodically manage their irrigation before, during, and after droughts.

How much do you think the median wage earner makes?

I have found this to be a great resource for general finance and investing knowledge. Hope to eventually see a Bogleheads community here. :)