I’m not sure I follow. They are trying to do a magic trick where they pay $1 and they get infinite money in return?

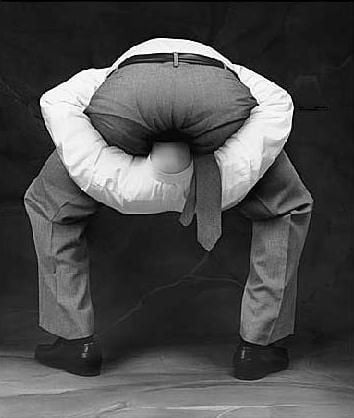

Economists hate this one weird trick!

You have to realize that people who are easily grifted think it must be easy to grift. True grifting takes a degree of thoughtfulness and intelligence (I didn’t say much).

They get grifted so easily they’re able to grift themselves with these half-formed ideas.

Yuuuuup.

Sovcits are exclusively about magic tricks. Magic tricks so that the cops can’t pull them over, magic tricks so that they don’t have to pay taxes for the services they use, magic tricks so that the law doesn’t apply to them. None of them work, of course, it usually just amounts to tax fraud.

I think the dumb part is that a deposit on your account is always a credit to the account. They are conflating a credit card with the credit piece of the journal entry that gets made.

Have… Have they never had a card declined for insufficient funds?

Because that is surely a thing. Sometimes banks are extra dicks and let the charge(s) through to save the cardholder from ‘embarrassment’ but then tack on an insufficient funds fee to every single charge separately. That they allowed. Knowing you had no money.

Maybe that doesn’t happen anymore, but it sure as fuck happened to me.

When I was in my early twenties, I opened a savings account and the banker didn’t tell me that the amount that I was depositing was bellow the minimum balance. I was instantly dinged. At that age, I wasn’t confident enough to call bullshit. I ate the penalty.

Today, I would demand a refund and I’d politely make it clear that I was taking my business elsewhere because the bank obviously didn’t have proper ethics training. I’d do it in such a way as to diplomatically put that person’s job at risk. If they didn’t get fired for ripping me off, they’d for sure be on notice with their boss.

Banks are so corrupt that they get away with all kinds of evil. But not at the lowly level of a peon in a branch. That I might tell friends and family about the experience might not protect the “little person” on the front lines. Execs can get away with fucking murder.

the amount that I was depositing was bellow the minimum balance

So they charged you not for owing them money, but for being too poor to have an account with them?

This one doesn’t seem to have a way to make it sound legit, does it. Any way you shake it, the banker should never have behaved that way.

I like your phrasing though, “too poor to have an account here”. The fact the “penalty” is money is just cruel.

I could have deposited the minimum amount, but she probably sensed that if I was told that it had to be more, I might choose not to open the account after all.

Doesn’t happen in Aus anymore following multiple investigations into banking sector misconduct over past couple of decades. Informal overdrafts are now illegal here for most accounts. But it sure as fuck happened to me too. Multiple times, I still remember it was a $35 fee anytime my balance went below zero. I was just a teenager with undiagnosed ADHD overestimating how much I had left. We didn’t have online banking yet, I couldn’t just check. And that was a significant part of my pay. Cunts.

I’ve never had it happen with a credit card (compounding interest is what kicks your ass there), but definitely a bank debit card. Most banks I know of these days still apply overdraft fees too.

Not sure if the sovcit is talking about doing this with a credit or debit card

Yup used to happen a lot to me. Haven’t had it happen in years, but Chase seems to want to really try doing it.

Without fail withdrawals happen at exactly midnight. Deposits won’t hit until 5am.

They were all slapped on the wrist in the last aughts and paid some DOJ fines in millions for billions in fees they collected for 15+ years and finally gave customers control as opt in

It’s not to save from embarrassment, it’s overdraft protection as a service on the account, and it’s expensive. If you don’t have overdraft protection it will just decline instead.

We didn’t get the response? @Bones, you’ve been consistently entertaining me with the posts that make me question how these people think. This was the opportunity to find out how they’d respond!

I’m deducting one internet point. Don’t worry, you have a mountain of them and won’t notice.

You cannot deduct an internet point from @Bones because @Bones is a private citizen, not to be confused with @BONES the legal entity, who did not sign any contract or license authorizing a deduction. But if you must have the point deducted, a special promissory note should suffice.

If you are not the CEO, please forward this message to the CEO. It is a violation to dispose of this message without forwarding it to the proper recipient.

I hope everyone tilted their screen 45° and applied their red filters.

I think you just said the magic words that make me a millionaire!

Thank you!

This shit SHOULD get old and stop making me laugh, but damnit it never does 🤣

Don’t challenge a bitch some guy, OP is here for you.

It’s like he’s throwing out a jumble of words and hoping that they somehow stick together in a way where he gets infinite money.

I can’t believe one of them actually admitted they sound crazy, are they becoming self aware?

Today you earned a gold star. Good job!

They have realized that the rules are all made up, but they incorrectly believe that the world is fair and they also get to make up rules. A sovcit is someone who has not realized that the reason the government can make rules is because those rules are backed by its monopoly on violence.

“Top contributor”

Depending on your bank, it might cover your ass for a tank of gas, but yeah that’s not how any of this works.