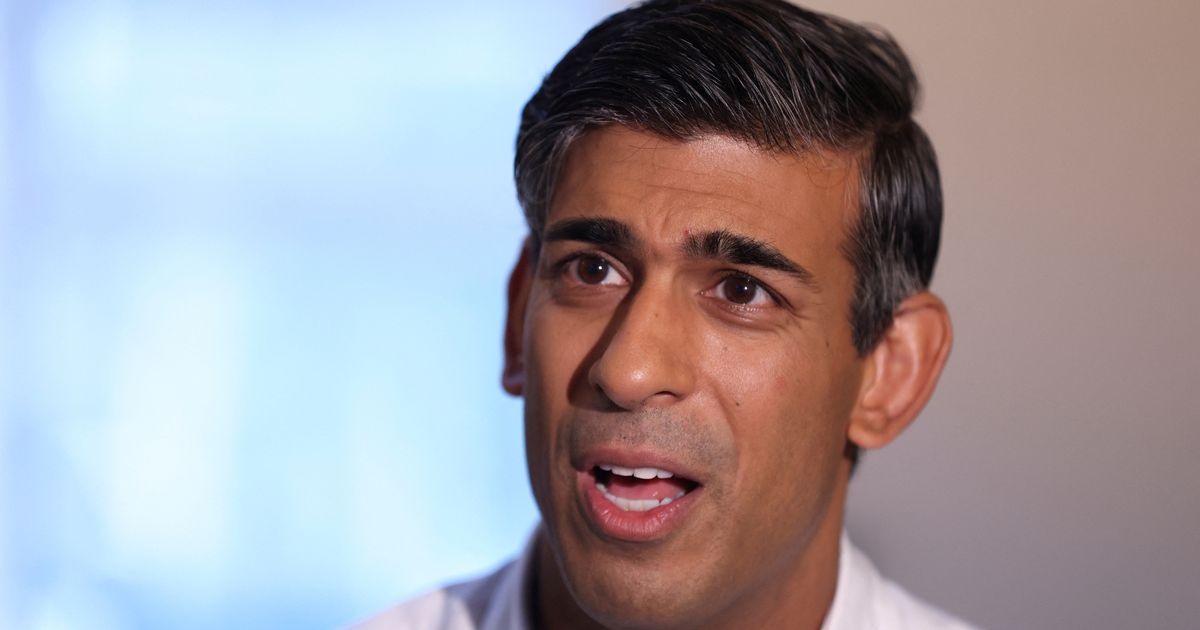

Sunak needs to go in the opposite direction: extend inheritance tax to the super wealthy, who typically hide their assets offshore and in trusts in order to avoid inheritance tax (amongst others). About 4% of people pay inheritance tax: essentially the top 2-5%. The 1% don’t pay any.

Sunak needs to go in the opposite direction: extend inheritance tax to the super wealthy, who typically hide their assets offshore and in trusts in order to avoid inheritance tax (amongst others).

You’ve just described his family.

Yep. I kind of wish that having those kind of tax arrangements automatically disqualified someone from being a politician. Not paying UK tax? You can’t be part of the UK’s government. Won’t happen, though.

How does money get “off shore” in the first place?

Can’t they implement stupid taxes on any money leaving the country? Like 25-50% or something?

As I understand it (and conceding that my knowledge is somewhat limited - I have a background in accountancy but all my clients were SME’s, who don’t use these schemes) it’s done through a combination of limited companies, shell companies, and trusts. The assets all get moved around in such a way that the super wealthy technically don’t own their own stuff anymore. They just own the company that owns the company that owns the assets, with one or more of the companies being registered in a tax haven rather than the UK, so that UK taxes don’t apply.

A decent government with sufficient backbone to stand up to the wealthy would close down loopholes like that, ensuring the assets are taxed when they “leave” the UK or taxing the owners regardless of whether they use a tax haven or not. It won’t happen, because neither of the main parties have the courage to stand up to the super rich.

I would love to see someone grow a spine and ban that overseas cop out. Shareholder companies should owning property should pay a tax rated at its value. It is used too much just to dodge tax and inheritances.

I would love to see that too! I’d also like to see capital gains and dividends taxes equalised with income tax - although these taxes were intended to encourage investment, the actual effect has been for the wealthy to essentially claim their income they get from working is actually capital gains or dividends, thus paying less tax. Plus there’s not a lot of evidence that lower taxes on dividends and capital gains boosts investment anyway.

We had money controls in the 70s but it basically led to poor inward investment and expats waiting for a change of government before coming back to the UK. Why move capital into a country you’re not sure you can take it out afterwards.

You have to be claiming

£1M£500k before you start paying inheritance tax for a direct family member. Remembering most of the time any value that is bequeathed is shared, it is easy to see why only 5% pay inheritance tax. There will be a lot more above those who simply dodge it by going offshore. Restrictions need tightening on inheritance tax not removing imo. Offshoring property needs to be banned outright.EDIT amount was wrong. It is £1m that you can claim if you are married. £500k for direct family and £375k for everyone else.

The threshold for inheritance tax in the UK is £325,000.

I have changed it with an edit. I need to check youtubers statement more. The amount was lifted to £500k for direct family members this year.

That can’t be right I’ve paid inheritance tax on my parents earnings and it definitely wasn’t 1 million pounds. I’d have noticed.

I have changed it with an edit. I need to check youtubers statement more. The amount was lifted to £500k for direct family members this year.