Snapshot of Eurozone inflation falls to 5.5% in sharp contrast to UK. Economists put reason for divergence down to Brexit and Britain’s energy price guarantee.

Brexit is the gift that keeps on giving.

The government can only pretend external factors are entirely to blame for so long. As more and more evidence like this continues to pile up, it will become politically untenable. Eventually it’ll just be the maddest of the mad still in the Brexit camp and the less devoted Brexiteers will want to disassociate.

Did you even read the article?

Economists said most of the reason for the divergence between the UK and the EU was down to the UK government’s energy price guarantee (EPG), which has capped the cost of gas and electricity bills to the equivalent of £2,500 a year for a typical household until July. In the eurozone there have not been similar caps fixing the price over a lengthy time period, meaning their inflation rates better reflect the recent global decline in wholesale gas and electricity prices.

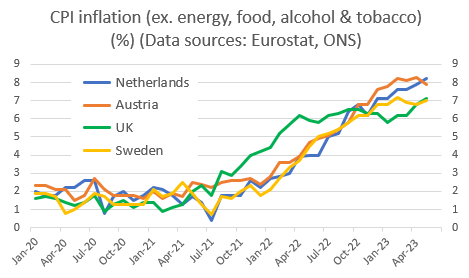

Did Austria, the Netherlands and Sweden brexit as well?

Edit. Why is it ok to compare UK to average of the Eurozone but not to the countries with high inflation? Double standards methinks

Literally the first paragraph says “economists put it down to brexit”. But I’m sure you had enough of experts.

The experts said that inflation was temporary. Look how its going now.

and Britain’s energy price guarantee

And you’re ignoring the second half of the first paragraph?

Why?

Not ignoring it. Of course there are other factors. But brexit is definitely a factor. Therefore: Brexit, the gift that keeps on giving.

Economists said most of the reason for the divergence between the UK and the EU was down to the UK government’s energy price guarantee (EPG), which has capped the cost of gas and electricity bills to the equivalent of £2,500 a year for a typical household until July. In the eurozone there have not been similar caps fixing the price over a lengthy time period, meaning their inflation rates better reflect the recent global decline in wholesale gas and electricity prices.

I work in agtech, brexit is a gift, it’s caused disruption that’s a great catalyst for investment in regenerative and vertical farming

Problems are opportunities

Wage growth is also high as a result of the labour squeeze that brexit is partially affecting

Problems are opportunities

Oh oh I know this one. Freedom is slavery and ignorance is strength right?

No, solutions = £

That seems suitably vague.

be specific, what can you do now that you couldn’t have done in the EU and why has that caused more investment that wouldn’t have happened anyway?

The CAP is an environmental disaster. The UK has now created its own agriculture policy that does not subsidise production. This was not possible whilst in the EU.

I’m happy to hear of a positive side effect of brexit. I’m not going to lie, I think it’s the first.

A factor, but clearly not the primary one.

Why are you excluding energy and food?

Nevermind cherry picking 3 countries from the EU.

Also we’re comparing statistics from two different organisations. The ONS was significantly defunded early on in the Tory government’s rule under David Cameron, while other departments forming the checks and balances against Westminster were completely closed down - the clear message being that if the ONS didn’t step into line with the government’s narrative then their jobs would be next.

Meanwhile Eurostat exists to compare data between all EU countries, yet here we only see 3.

That’s a conspiracy theory. Show me one respected statistician that casts any doubt on the ONS’ output

They are the 3 European countries with high inflation, I’m guessing you don’t know the reasons why? Hint, energy price caps and their implementation.

It’s not a theory to say that the ONS was defunded in the early 2010’s and stopped tracking various metrics.

They are 3 European countries with high inflation, sure, but they’re not 3 EU countries that the UK is regularly compared with. They have been cherry picked for this graph.

And furthermore as far as I can tell Eurostat don’t do a CPI measurement that excludes energy, food, alcohol & tobacco. Which begs the question: why don’t they present the actual data they used to make the graph?

The simple truth is that the UK lost its direct comparison to EU countries when we left in 2019. Which, incidentally, is just before the start of this graph.

Any changes to ONS methodology is published openly. Again, source please.

Core inflation excludes volatilities, that’s literally the definition

And why not compare countries with high inflation?

It’s called core inflation. It doesn’t include volatiles.

The intended use of core inflation is when the base assumption holds true, that assumption being demand for food and energy will not reduce as price increases.

That assumption has not held, we’ve seen a reduction in demand for both as budgets have been squeezed to breaking point, even with the price caps.

That doesn’t change the definition of core inflation…

I never said it did, but it does change whether it’s an appropriate measure to use.

Why not suggest one that is then

… Sweden isn’t in the Eurozone.

Neither is the UK… The problem with being in the eurozone is that member states have no central bank. Spain, for example, is unable to reduce interest rates despite their CPI being under the ECB target of 2% and unemployment over 13%

Instead, the ECB will probably be hiking rates more to quell inflation in other member states.

This is a weird argument. The US, undoubtedly the world’s strongest economy, has a single central bank covering the Deep South and the coasts, which are also running at two different speeds. The job of Spain is to run a decent economy with no deficit, something they continually fail to do. Sure you can blame it on lack of central bank, but they’ve got other tools available for them as well.

So because the US has terribly performing states, that somehow justifies not being able to set your own monetary policy? That’s a weird argument.

Maybe the reason Spain and all the other Southern European countries that struggle to run a decent economy is because the euro is set up to benefit the biggest manufacturers…

Oh don’t worry they were struggling to do well before the euro. You could argue that being a euro member saved some of them during the crash.

No doubt. European austerity made it worse though post GFC. The US and China used a shed load more fiscal stimulus than the EU, and have added trillions of extra GDP as a result.

Excluding the 4 things that affect poor people the most? Cool 👍

Lol, I didn’t invent the definition of core inflation mate. Take it up with the economists

I know we’ll not regain the special privileges we had and will need to eventually move toward the Euro but good lord we should be rejoining the EU posthaste.

You do realise that Germany and Italy are in a literal recession right now, with negative growth rather than slowing growth? I don’t think that’s Brexit.

Ever since after world war 2 Uk inflation has been high compared to other nations in Europe and the US. Get your cash out of the UK. Invest in the S&P500